Supplier Finance Deutsche Bank

Middle East and Africa head of trade and supply chain finance product at Bank of America describes ESG-linked financing as increasingly robust. The opportunity to benefit from better terms when negotiating with suppliers.

Deutsche Bank Refinances Us 3 5bn Trade Finance Securitisation Global Trade Review Gtr

Deutsche Bank today announced that it has established a supply chain financing solution for BASF China supporting the company and its suppliers in China with world-class working capital capabilities.

Supplier finance deutsche bank

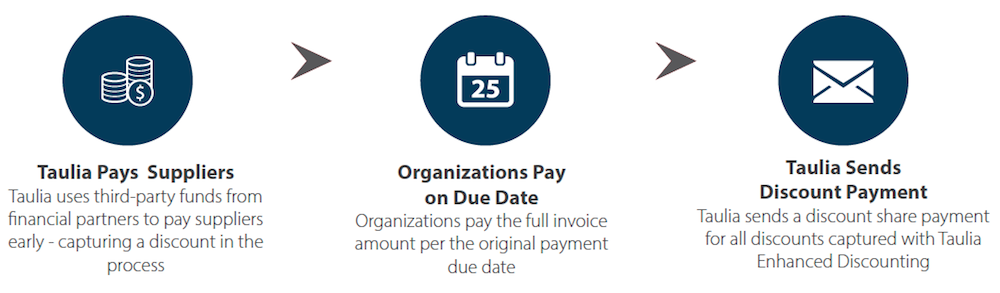

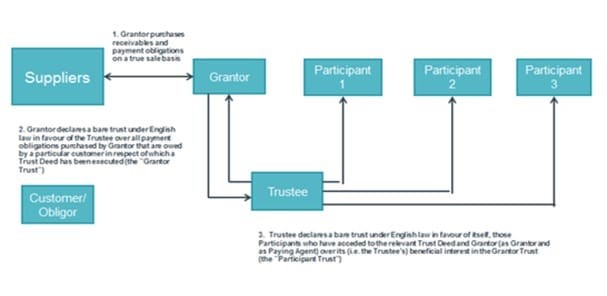

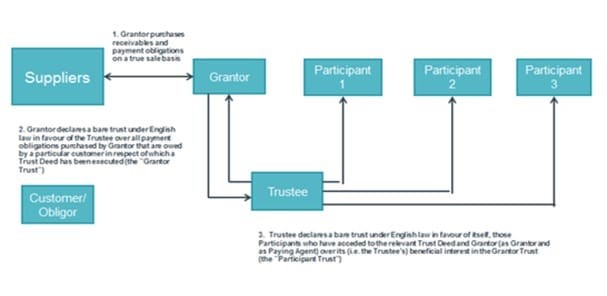

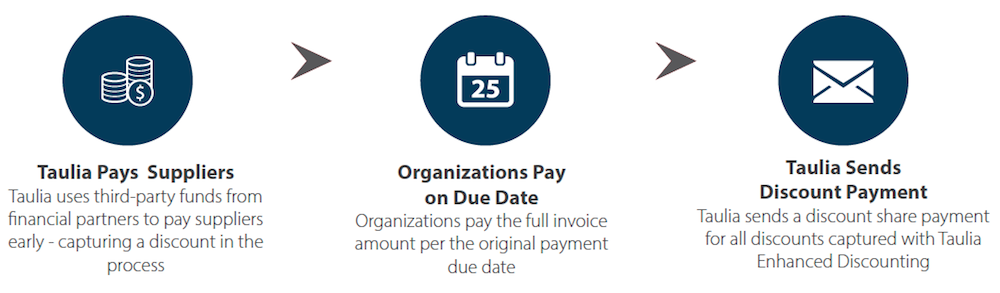

. A guide to working capital optimisation 2nd edition Payables Finance. On the day it emerged that one of the primary areas of interest and concern for corporates is the accounting impact of Supplier Financing for buyer organisations. This solution is used by manufacturing companies and product distributors. Deutsche Bank Financial Supply Chain Whitepaper 2015 Cash SalesAR InventoryAP Days sales outstanding Days payables outstanding Days inventory outstanding 12 Payables finance This guide focuses specifically on payables finance a buyer-led supply chain finance.Welcome to Deutsche Bank Global Procurement. Deutsche Bank launches supply chain finance app Tuesday 6 August 2013 0958 CET News. You will find details of our policies processes and purchasing platform. Deutsche Bank is a leading provider of financial services to agencies corporations governments private individuals and institutions in the Americas.

Also it refers to the techniques and practices used by banks and other financial institutions to manage the capital invested into the supply chain and reduce risk for the parties involved. Essential Deutsche Bank system maintenance weekend of 26th June and 27th June 2021. The interactive workshop brought together supplier finance specialists accountants and key bankers from Deutsche Banks trade finance and cash management franchises. Deutsche Bank CorporatesInstitutions Private Clients.

Faced with the options of cash to fund a corporate finance strategy or cash to meet a 30-day supplier schedule the revenue-generating activity will be more alluring. A successful program establishes a diverse and growing supplier portfolio that reflects the diverse customer base of the company. Sustainable supply chain. To support sustainability our supply chain initiative applies strict environmental social and ethical criteria to the suppliers we do business with.

Supply chain financing or reverse factoring is a form of financial transaction wherein a third party facilitates an exchange by financing the supplier on the customers behalf. As a leading supply chain finance bank globally we need to keep investing in this space to support our clients Ip points out. It provides companies with credit facilities to buy goods enabling them to grow the business. Moreover the Corporate Bank aims to boost its supply chain financing volume to one billion euros and offer its 800000 commercial clients at least two standardised ESG financing solutions by the end of the year.

With this solution BASF and its partners will benefit from more accessible risk mitigation and improved working capital flows automated. A guide to working capital optimisation. Deutsche Bank is a leading provider of financial services to agencies corporations governments private individuals and institutions in the Americas. Organizing the procurement process responsibly.

Supplier financing is a component of supply chain financing and plays an important role in improving the cash flow and operations of many companies. This portal will provide information for our existing and potential vendor partners on how to conduct business with Deutsche Bank. The Financial Supply Chain Manager app enables clients to access receivables finance and supplier finance solutions via one central a ccess point. Savings on administrative costs as your supplier payments are fully automated.

Deutsche Banks Supplier Diversity Program seeks to provide businesses owned by minorities women and disabled veterans equal access to purchasing opportunities. Trade Finance delivers fast efficient reliable and comprehensive solutions for every stage of a clients trade value chain to support their foreign trade activities Trade Finance offers comprehensive solutions along the clients trade value chain by combining international trade risk mitigation products and services with custom-made solutions for structured trade and export finance. Since Deutsche Bank spends over 8 billion each year on goods and services the initiative makes a real difference. Deutsche Banks assessment standards are set in line with the EU Taxonomy for Sustainable Activities and various market standards.

Through the Supplier Payments system you simply confirm the invoices which you have received and we handle your companys payments and offer immediate finance to your suppliers. Having first established a presence in the Americas in the 19th century the bank began independent operations in the US in 1978 opening its first North American branch in New York City. Deutsche Bank brings forward its target date for 200 billion euros of sustainable finance by two years to 2023. Leveraging such capability Deutsche Bank has done fairly well on supplier onboarding where the bank has made quite a lot of investment.

Having first established a presence in the Americas in the 19th century the bank began independent operations in the US in 1978 opening its first North American branch in New York City.

Supply Chain Finance 2021 Guide Trade Finance Global

Beyond The Invoice Deutsche Bank

Adb Deutsche Bank Enter Supply Chain Finance Deal Supporting Smes In Developing Asia Asian Development Bank

Payable Finance Solutions Corporate Bank

Working Capital Management And Financing Opportunities In The Supply Chain Ctmfile

Supply Chain Finance Corporate Bank

Guest Blog Covid 19 And Supply Chain Resilience Icc International Chamber Of Commerce

Payable Finance Solutions Corporate Bank

Gt Nexus Supply Chain Use Deutsche Bank For New Efficiencies In P2p Service Ctmfile

Supply Chain Finance Is Not Necessarily Best Way To Help Fund Your Suppliers Ctmfile

Supply Chain Finance Europe Barometer Screwing Suppliers Dominates Why Introduce Ctmfile

Payable Finance Solutions Corporate Bank

Deutsche Bank Replaces Sayer As Global Head Of Structured Trade And Export Finance Global Trade Review Gtr

Payable Finance Solutions Corporate Bank

Http Documents1 Worldbank Org Curated En 359771613563556978 Pdf Supply Chain Finance By Development Banks And Public Entities Handbook Pdf

Insider Thoughts The Greensill Story And Its Impact On Supply Chain Finance May 2021

A guide to working capital optimisation. Supply chain financing or reverse factoring is a form of financial transaction wherein a third party facilitates an exchange by financing the supplier on the customers behalf.

Http Documents1 Worldbank Org Curated En 359771613563556978 Pdf Supply Chain Finance By Development Banks And Public Entities Handbook Pdf

The interactive workshop brought together supplier finance specialists accountants and key bankers from Deutsche Banks trade finance and cash management franchises.

Supplier finance deutsche bank

. Also it refers to the techniques and practices used by banks and other financial institutions to manage the capital invested into the supply chain and reduce risk for the parties involved. Deutsche Banks assessment standards are set in line with the EU Taxonomy for Sustainable Activities and various market standards. Deutsche Bank Financial Supply Chain Whitepaper 2015 Cash SalesAR InventoryAP Days sales outstanding Days payables outstanding Days inventory outstanding 12 Payables finance This guide focuses specifically on payables finance a buyer-led supply chain finance. Supplier financing is a component of supply chain financing and plays an important role in improving the cash flow and operations of many companies.A successful program establishes a diverse and growing supplier portfolio that reflects the diverse customer base of the company. The Financial Supply Chain Manager app enables clients to access receivables finance and supplier finance solutions via one central a ccess point. Having first established a presence in the Americas in the 19th century the bank began independent operations in the US in 1978 opening its first North American branch in New York City. This portal will provide information for our existing and potential vendor partners on how to conduct business with Deutsche Bank.

Deutsche Bank CorporatesInstitutions Private Clients. Deutsche Banks Supplier Diversity Program seeks to provide businesses owned by minorities women and disabled veterans equal access to purchasing opportunities. A guide to working capital optimisation 2nd edition Payables Finance. Deutsche Bank launches supply chain finance app Tuesday 6 August 2013 0958 CET News.

Faced with the options of cash to fund a corporate finance strategy or cash to meet a 30-day supplier schedule the revenue-generating activity will be more alluring. Deutsche Bank is a leading provider of financial services to agencies corporations governments private individuals and institutions in the Americas. Sustainable supply chain. Through the Supplier Payments system you simply confirm the invoices which you have received and we handle your companys payments and offer immediate finance to your suppliers.

Deutsche Bank brings forward its target date for 200 billion euros of sustainable finance by two years to 2023. This solution is used by manufacturing companies and product distributors. On the day it emerged that one of the primary areas of interest and concern for corporates is the accounting impact of Supplier Financing for buyer organisations. As a leading supply chain finance bank globally we need to keep investing in this space to support our clients Ip points out.

Essential Deutsche Bank system maintenance weekend of 26th June and 27th June 2021. Welcome to Deutsche Bank Global Procurement. Leveraging such capability Deutsche Bank has done fairly well on supplier onboarding where the bank has made quite a lot of investment. It provides companies with credit facilities to buy goods enabling them to grow the business.

Savings on administrative costs as your supplier payments are fully automated. With this solution BASF and its partners will benefit from more accessible risk mitigation and improved working capital flows automated. Deutsche Bank is a leading provider of financial services to agencies corporations governments private individuals and institutions in the Americas. Having first established a presence in the Americas in the 19th century the bank began independent operations in the US in 1978 opening its first North American branch in New York City.

You will find details of our policies processes and purchasing platform. Trade Finance delivers fast efficient reliable and comprehensive solutions for every stage of a clients trade value chain to support their foreign trade activities Trade Finance offers comprehensive solutions along the clients trade value chain by combining international trade risk mitigation products and services with custom-made solutions for structured trade and export finance. Moreover the Corporate Bank aims to boost its supply chain financing volume to one billion euros and offer its 800000 commercial clients at least two standardised ESG financing solutions by the end of the year. To support sustainability our supply chain initiative applies strict environmental social and ethical criteria to the suppliers we do business with.

Since Deutsche Bank spends over 8 billion each year on goods and services the initiative makes a real difference. Organizing the procurement process responsibly.

Supply Chain Finance Europe Barometer Screwing Suppliers Dominates Why Introduce Ctmfile

Supply Chain Finance Corporate Bank

Beyond The Invoice Deutsche Bank

Deutsche Bank Refinances Us 3 5bn Trade Finance Securitisation Global Trade Review Gtr

Deutsche Bank Replaces Sayer As Global Head Of Structured Trade And Export Finance Global Trade Review Gtr

Gt Nexus Supply Chain Use Deutsche Bank For New Efficiencies In P2p Service Ctmfile

Supply Chain Finance 2021 Guide Trade Finance Global

Guest Blog Covid 19 And Supply Chain Resilience Icc International Chamber Of Commerce

Payable Finance Solutions Corporate Bank

Working Capital Management And Financing Opportunities In The Supply Chain Ctmfile

Adb Deutsche Bank Enter Supply Chain Finance Deal Supporting Smes In Developing Asia Asian Development Bank

Payable Finance Solutions Corporate Bank

Payable Finance Solutions Corporate Bank

Payable Finance Solutions Corporate Bank

Insider Thoughts The Greensill Story And Its Impact On Supply Chain Finance May 2021

Supply Chain Finance Is Not Necessarily Best Way To Help Fund Your Suppliers Ctmfile

Posting Komentar untuk "Supplier Finance Deutsche Bank"